By Sudarsan.S.K

BUDGET 2020 – AN OVERVIEW

The budget of the Central Government for the year 2020-21 was presented by Finance Minister, Nirmala Seetharaman, on 01st February, 2020 in the Parliament. Through this article we are looking into the major proposals in the budget effecting the common man in relation to Income Tax i.e. the Income Tax Rate Slabs applicable for Individuals. Let’s have a look at the proposal regarding the same in the Budget.

Up to income of Rs. 2.5 lakhs                               :        Nil

Income more than Rs. 2.5 lakhs up to 5 lakh        :        5%

Income more than Rs. 5 lakhs up to 7.50 lakh      :        10%

Income more than 7.50 lakhs upto 10 lakhs         :        15%

Income more than 10 lakhs up to 12.50 lakhs      :       20%

Income more than 12.50 lakhs up to 15 lakhs      :       25%

Income above Rs. 15 Lkahs                                  :        30%

*Rebate u/s 87A has been kept unchanged so that assessees with income up to Rs. 5 lakhs shall not have to pay any tax

**The above tax rates and income tax exemption slabs are under new simplified Personal Tax Regime which shall be optional and shall be applicable without claim to any deduction or exemptions.

Here is the list of exemptions and deductions that a taxpayer will have to give up while choosing the new tax regime.

*** The tax calculated on the basis of such rates will be subject to health and education cess of 4%.

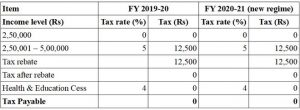

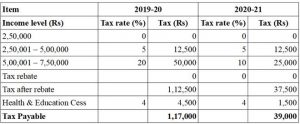

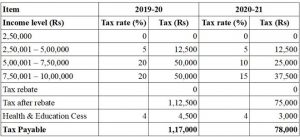

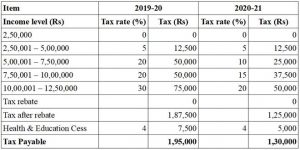

The effect of the new rates and old rates on the Tax Payable can be summarised as below. It is based on assuming no deductions under Sec 80 and exemptions claimed Under Sec 10 as required in the budget proposal

If you are availing deductions u/s 80 or exemptions u/s 10 and in a dilemma as to whether old scheme or New Simplified Tax scheme is beneficial for you, the below break levels of total Deductions/ Exemptions can be your decision criteria. If your total Deductions and Exemptions are equal to or exceeding the below break even levels, Old Tax Scheme is beneficial for you

| Gross Income | Under 60 Years | Above 60 years | Above 80 Years |

| 5,00,000 | nil | nil | nil |

| 6,50,000 | 75,000 | 62,500 | 12,500 |

| 7,50,000 | 1,25,000 | 1,12,500 | 62,500 |

| 8,50,000 | 1,50,000 | 1,37,500 | 87,500 |

| 9,50,000 | 1,75,000 | 1,62,500 | 1,12,500 |

| 10,00,000 | 1,87,500 | 1,75,000 | 1,25,000 |

| 11,00,000 | 1,87,500 | 1,75,000 | 1,25,000 |

| 12,50,000 | 2,08,350 | 2,00,000 | 1,66,650 |

| 13,50,000 | 2,25,000 | 2,16,650 | 1,83,350 |

| 15,00,000 | 2,50,000 | 2,41,650 | 2,08,350 |

| >15,00,000 | 2,50,000 | 2,41,650 | 2,08,350 |

Hence the decision of whether to opt for New Tax Scheme or continue in Old Scheme as part of your Tax Planning is based on the whether the amount of Deductions you have for claiming is above these limits or not. Points to remember while opting for the new tax regime:

Kindly do consult a professional for your tax planning for 2020-21 to get a full picture and plan your taxation. The author can be reached at sudarsan@snco.co.in.

Sudarsan.S.K

CEO, SNCO Group

If you would like to know more or have any questions, please fill up your details and we will get back to at the earliest.